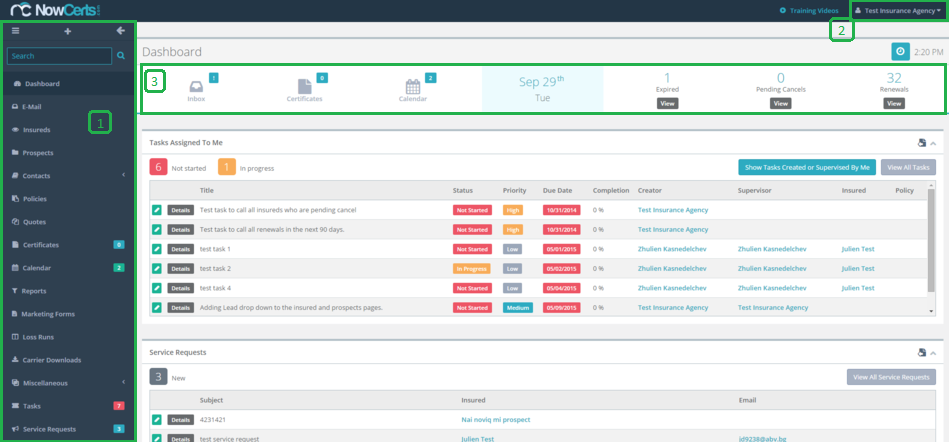

Dashboard Overview

Welcome to Momentum AMS. The most powerful Agency Management System (AMS). You will find NowCerts.com to be robust and easy to use. This section will explain Momentum AMS' basic layout:

- Main Menu (marked as 1): This is the main navigation tool between different everyday operations of your system.

- Agency Menu (marked as 2): This menu is used to setup up your account, your agents, and submit Agency Requests.

- Dashboard Stats (marked as 3): This bar shows stats about your activity and provide quick links operations due.

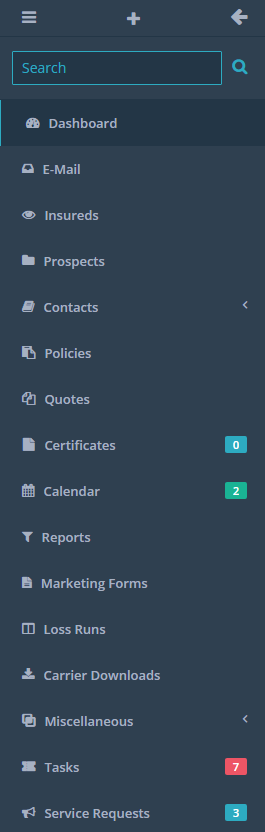

Navigation Menu

- The navigation toggle on the top ( ≡ ) is used to minimize the menu screen and expand your work surface (and vice versa).

- You can click on the ( + ) to quickly add an item.

- The search bar inside of the Main Menu is a global search field. Since it is a global search method, it might return many results. It is recommended you choose your specific section from below, e.g. Insureds, and search for the desired term in that screen. That way, your results would be limited to that section.

- Some of the menu items will show a number next to them to signify an action required or a recent change.

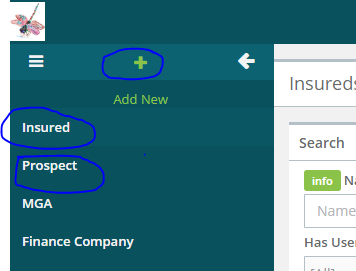

Adding New Clients and Prospects

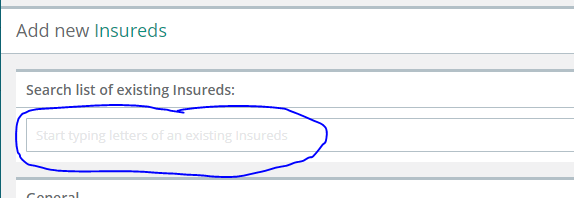

Click "Add New" (the plus sign in the top left corner) and select "Insured" or "Prospect."

You can fill in all of the pertinent information for your insured, such as name, social, date of birth, drivers' license number, phone number, email, etc. Remember to check your list of existing insureds and/or prospects to ensure you are not making duplicate entries for them.

Links to Tutorial Videos:

Entering in a prospect/insured:

Deleting an insured/prospect:

Making a prospect into an insured:

Merging duplicate entries of insureds/prospects:

Summary of "Merging duplicate entries of insureds/prospects" video:

Sometimes when entering in insureds or prospects, a duplicate is created. This can also happen when processing carrier downloads. To merge an insured, go into the details of the insured and under the general tab select "Merge Insureds". It is important to remember to merge into the insured that is the most accurate, including contact info. In the "Merge Insureds" page, you can enter in the name of the insured and it will give you your options. The insured that is in red is the insured you are merging into. The insured in black is the one you want to select. After clicking on "Merge", you will see the merged insured’s name under their aliases.

Entering policies:

Deleting policies:

Caution: Please be careful when deleting policies. Once they are deleted, they cannot be recovered, only recreated. If you do not have the permissions in your agent configuration to delete a policy, please see your agency admin for assistance.

Reassigning a policy to a different insured:

Master certificates/Sending certificates/Additional interests:

Mass action certificates: (video coming soon)

Adding endorsements/Billing types: (video coming soon)

Things to keep in mind when choosing what type of billing you need to use:

- What is the breakdown for the premium due (down payment, financing, PIF)?

- Are there any non-premium items (fees, taxes, other)?

- What payments do I need to collect from insureds (receivables)?

- What funds do I need to send out to carrier/MGA (payables)?

- What commissions do I need to record?

- What non-commission revenue do I need to record (fees)?

With that in mind, here are the types of billing we have:

Direct bill:

Summary of "Direct bill" video:

The carrier or the MGA handles all the billing. The agency does not handle any money. For this type of billing, the agency does not need to generate any records aside from noting the change of coverage AND recording commission. There are no receivables from the insured and no payables to the carrier/MGA.

Direct bill with down payment:

Direct bill with down payment:

Summary of "Direct bill with down payment" video:

Direct bill with down payment" video:Direct bill, but with a twist. The agency needs to collect a down payment. The rest of the billing is done by the carrier (as above in the direct bill). There are just two transactions to record: the receivable for the down payment and the payable for the down payment (net of commission to the carrier). The fees and commissions remain as separate billing types.

Direct bill, but with a twist. The agency needs to collect a down payment. The rest of the billing is done by the carrier (as above in the direct bill). There are just two transactions to record: the receivable for the down payment and the payable for the down payment (net of commission to the carrier). The fees and commissions remain as separate billing types.Agency bill paid in full (PIF):

Summary of "Agency bill paid in full (PIF)" video:

In this case, the agency is responsible for collecting the entire premium, but it is all paid in the beginning. This, in effect, is similar to "direct bill with a down payment". There are just two transactions to record.

Agency bill with outside financing:

Summary of " Agency bill with outside financing" video:

In this case, the agency collects the down payment and then arranges for a finance company to finance and collect payments for the balance. Practically, it is similar to "agency bill paid in full (PIF)" explained above. The agency only collects one receivable and only sends out one payable.

Agency bill with inside financing (where the agency processes the financing): (video coming soon)

Agency bill - monthly:

Summary of "Agency bill - monthly" video:

The agency is responsible for collecting all installments on a policy (e.g. a commercial policy usually has a 25% down payment plus 9 monthly installments).

Creating invoices:

You can create an invoice after adding an endorsement with payables and receivables included. Here’s how:

Editing an endorsement with invoices and payments attached:

Reconciliations

The Momentum AMS commission reconciliations module allows users to mark hundreds of commissions as paid within seconds. Here is a quick overview of the process:

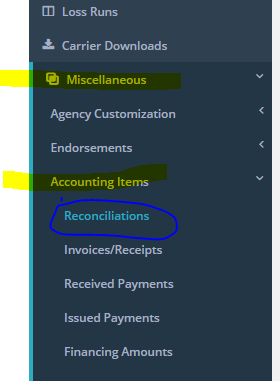

1. Find the "Miscellaneous" tab and expand it downward. Then, find the "Accounting Items" tab and expand that downward as well. Click on "Reconciliations". First, the idea is to reconcile agency commission, so then you can pay agents/producers (from funds received by the agency).

2. First, lets "reconcile" agency commissions, meaning apply received payments to expected agency commission amounts. So, from the drop-down menu, select "Manually Reconcile Agency Commissions".

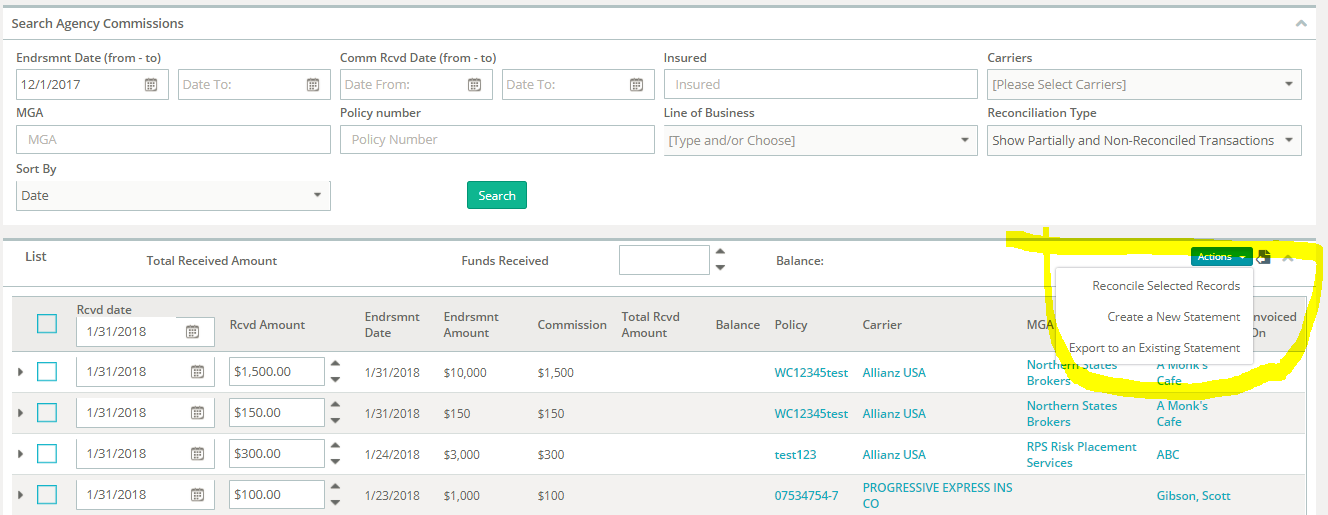

3. Use the filters to select a certain set of transactions. Typically, agencies use endorsement dates and a carrier/MGA to reconcile a statement they received.

Example:

Select the records you want to reconcile (to apply a received commission payment). Make sure you verify the suggested amount and the payment date. Then, from "Actions" select "Reconcile." Selecting "Create new statement" will also reconcile the selected commissions.

That's it. You now have the potential to apply payments to thousands of agency commissions in mere minutes.

Uploading documents:

Filling out Acord forms/Applications:

Workflow - Tasks/Activity Reminders

Momentum AMS offers a plethora of tools to help users manage their workflow and to help agencies manage their workload to stay on top of production and support.

On the navigation menu, you have your "Tasks," "Activity reminders," "To-do list," "Opportunities," "Service requests," "Endorsement status," "Upcoming renewals," "Important dates," "User messages/notifications," etc.

With so many tools and resources, it's not surprising that new users often ask us: "what are the differences between tools?" and "what tools do I need to/should use?"

There isn't one single correct answer. It depends on your unique work habits and responsibilities. Users with various work habits and responsibilities find certain tools to be more effective and helpful than others for managing their workflow. Below are brief descriptions of the various tools and resources on your navigation menu that should help you decide what tools are best suited for your needs and work style.

There isn't one single correct answer. It depends on your unique work habits and responsibilities. Users with various work habits and responsibilities find certain tools to be more effective and helpful than others for managing their workflow.

Tasks

When do we use "Tasks"?

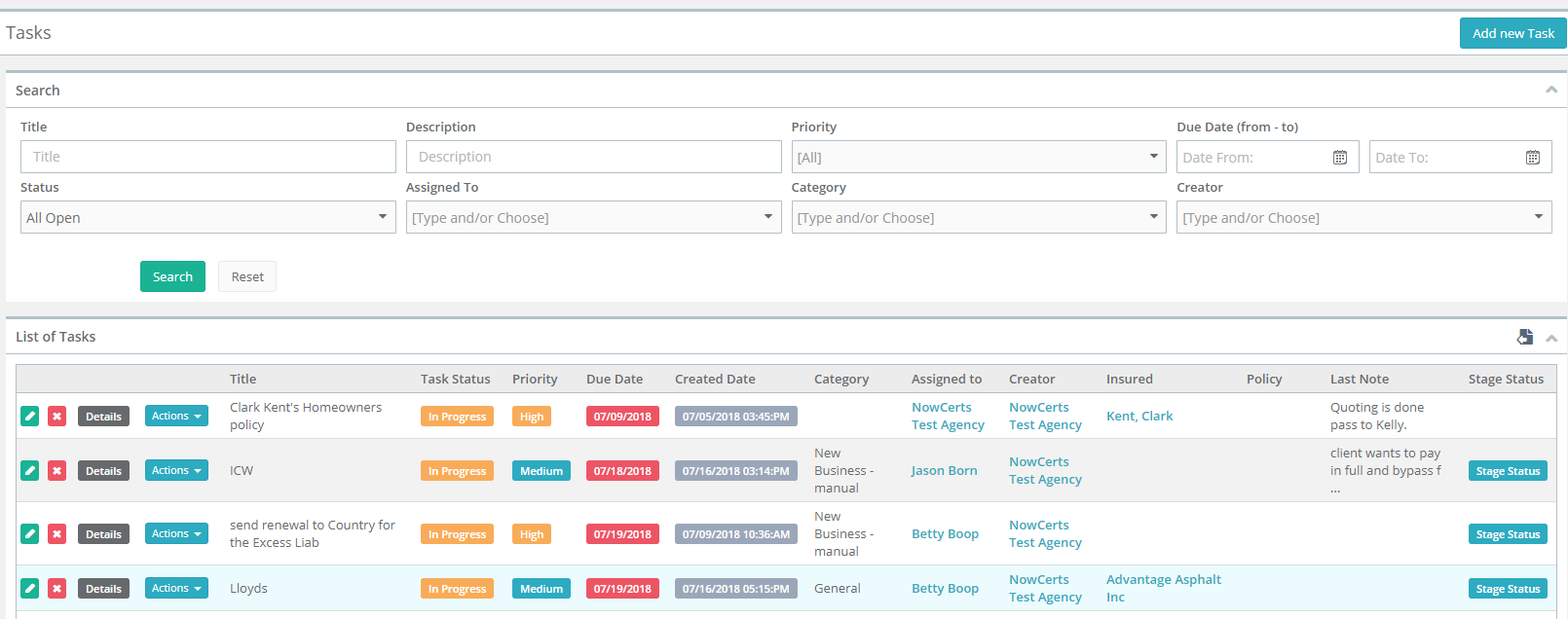

Tasks are the primary (and most popular) mode of distributing and keeping track of workflow, especially in agencies with multiple users who have defined roles. Tasks are exactly what they sound like. Tasks can be customized to create a standardized workflow that all agents can use.

This can be done by going to "Miscellaneous" on the navigation menu. Then, "Agency Customization," "Tasks," and finally "Categories and Stages". As an example, you could create the category "Renewal." The first "stage" may be to contact the insured. The descriptions for stages would be instructions. In this example, the instructions might be to review coverages and insured items with the insured. Your next stage may be to collect loss runs, then maybe prepare applications, and etc.

If a stage is not necessary, it can be marked as such in the task it was created in. Each stage can be updated with regards to status. Notes/comments can be added to the tasks/stages as things progress, so there is a trackable history of what was done and when.

Remember, if you assign a task to an agent, that agent can only mark that task as "done". They will need to reassign it to the task's creator to have it marked as "complete" and removed from the agent's list of open tasks. This is by design. The hope is that the task's creator will be able to review the task as necessary and view what was done to complete it to give them peace of mind that the task was indeed completed. This also provides them with the opportunity to discover lessons worth teaching to help agents progress and learn from each other.

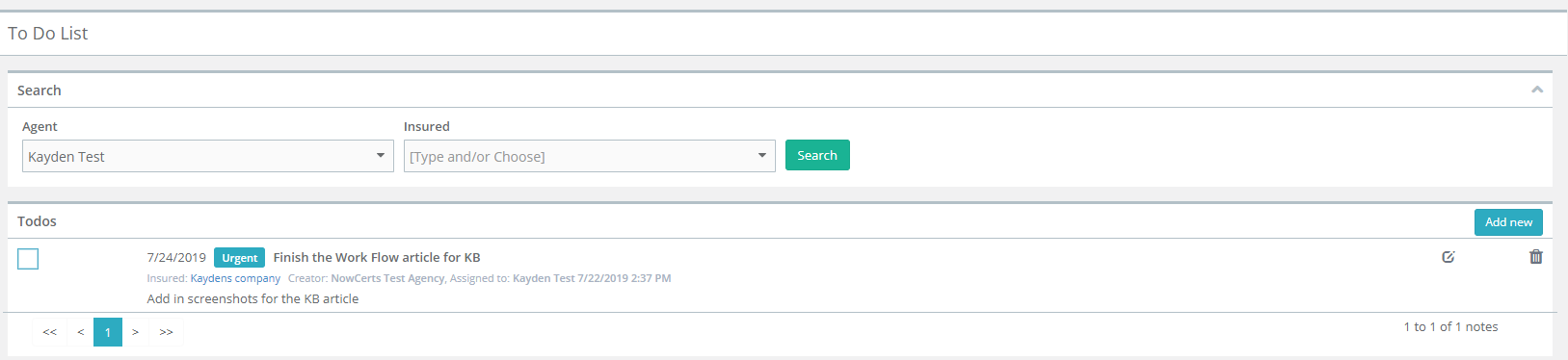

To-Do List

A to-do list is a simple one-and-done check-off list designed to remind you to do basic tasks. Everyday examples include: take out the trash, cancel my gym membership, & renew my driver's license.

Think of your Momentum AMS' to-do list as a long term wish list (e.g. "I need to change the oil in my Maserati"). This to-do list is not commonly used for daily workflow management.

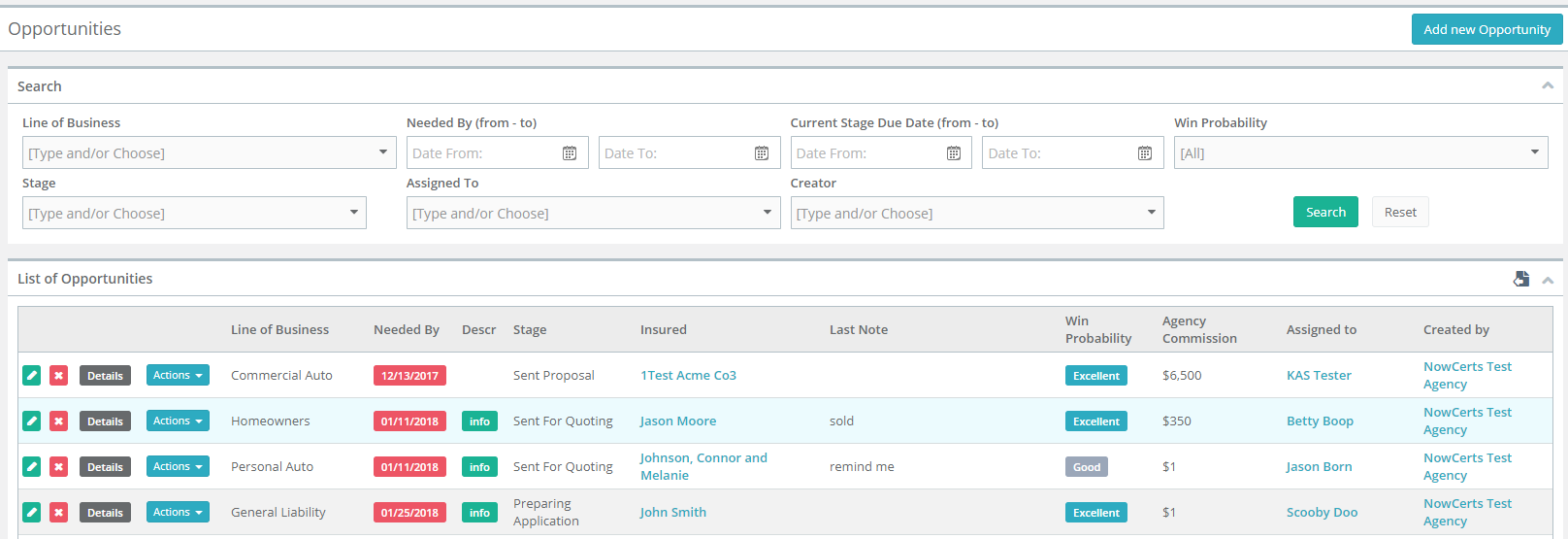

Opportunities

Opportunities are a commonly used tool in CRM systems. Opportunities are designed to manage sales and track production. These are new sales opportunities, cross-sell, and even renewals.

You may ask: "how do opportunities relate to prospects?" and "wouldn’t they be opportunities as well?"

Well, a prospect can have multiple opportunities. Think of a prospect as the insured and the opportunity as the prospect's policy. (Opportunity --> Quote --> Policy)

An insured can have an opportunity, too--- a cross-sell. Some agencies consider renewals as opportunities as well (especially in commercial lines).

Opportunities can also be a valuable tool for tracking quote-to-bind ratios for agents and to determine the value of a certain referral source. It is good to know if a referral is valuable and worth paying for.

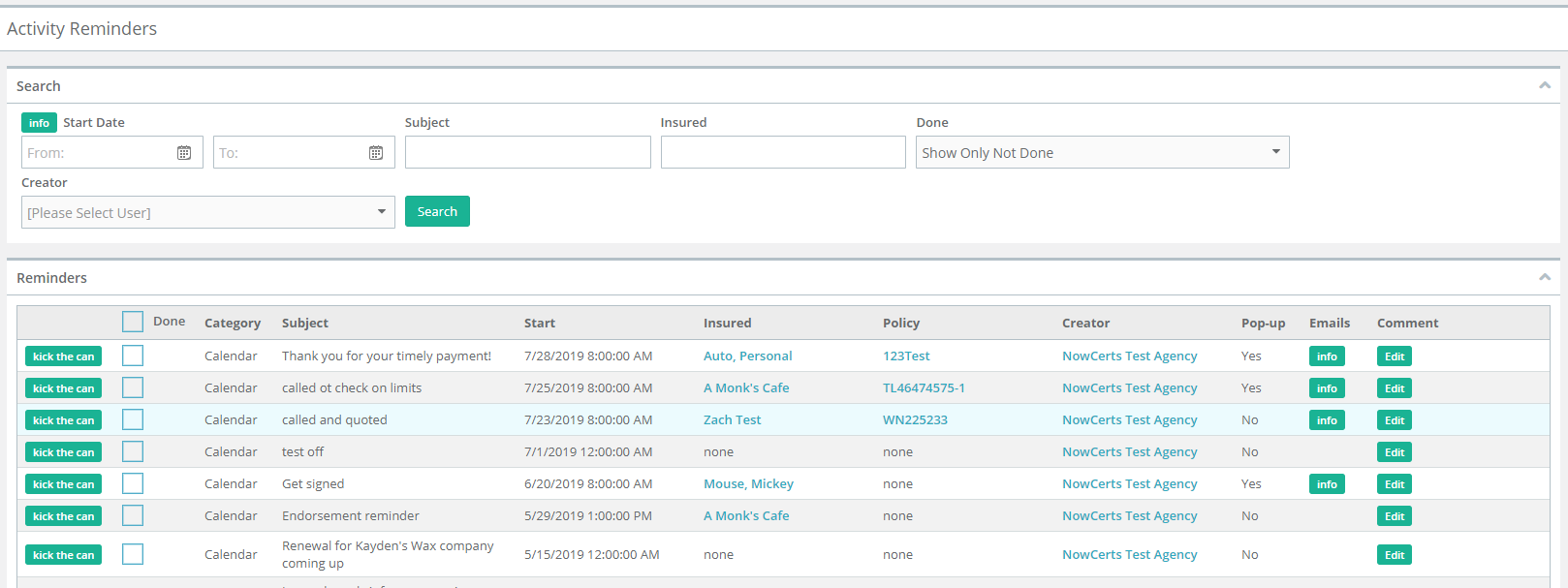

Activity Reminders

Often used alongside "Tasks," "Activity Reminders" are the most popular tool for managing workflow.

You may be pondering: "how do 'Activity Reminders' differ from 'To-Do’s'?"

You may be pondering: "how do 'Activity Reminders' differ from 'To-Do’s'?"Instead of a long term list of tasks to complete, Activity Reminders are calendar events. Users often think of the Activity Reminders list as their daily "to-do list." Activity Reminders are also called "Suspenses" in other systems. This page should be the first one users view when they log in every morning.

When properly used, Activity Reminders will notify the user what they need to be working on that day. When creating reminders, you are able to select to receive an email as an additional method of being notified that you have something to do or work on.

The "To-Do List" is designed to be more of a "wish list" while "Activity Reminders" is a list of work items that need to be completed. Unlike "To-Do's," "Activity Reminders" are date sensitive.

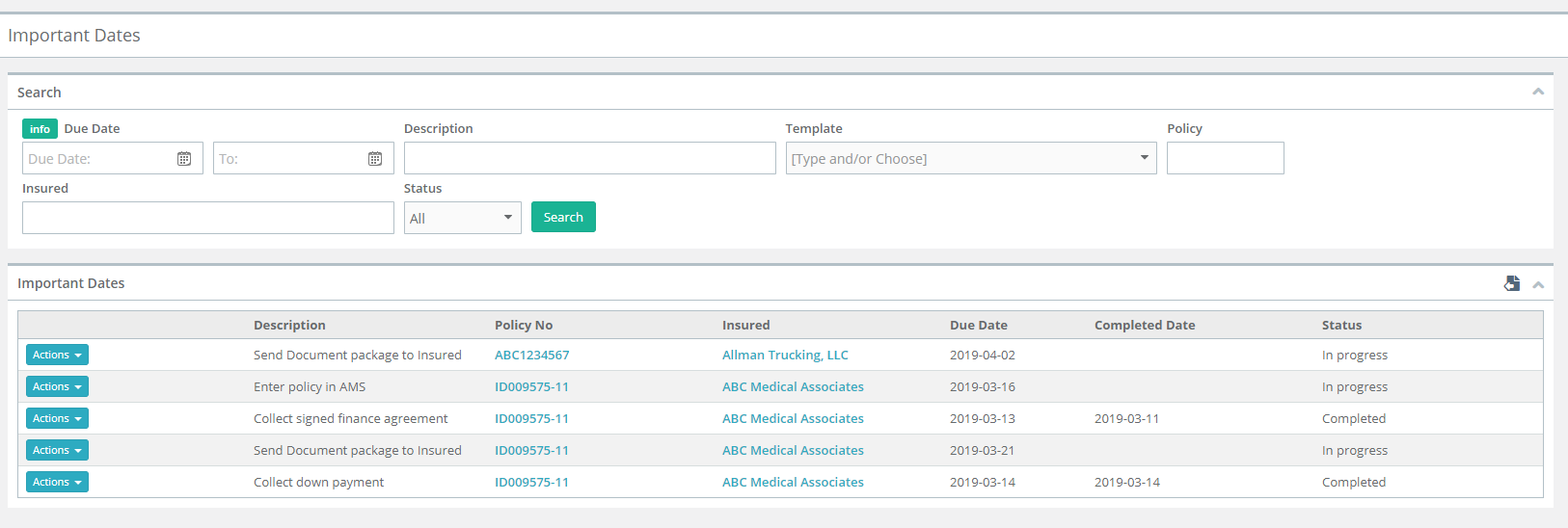

Important Dates

"Important Dates" is a user-defined checklist of items that need to be completed with each new policy (or renewal). You can define templates for "New Personal Auto," "Renewal BOP", etc. and have a checklist of things that need to be completed.

Example:

1. Collect e-signed application

2. Collect down-payment

3. Collect finance agreement

4. Send welcome email (or, trigger drip campaign)

5. etc.

"Important Dates" can be an invaluable tool to manage new policies and cut back E&O exposure.

On your navigation menu, go to "Miscellaneous" --> "Agency Customization" --> "Important Dates" to define your "Important Dates" templates.

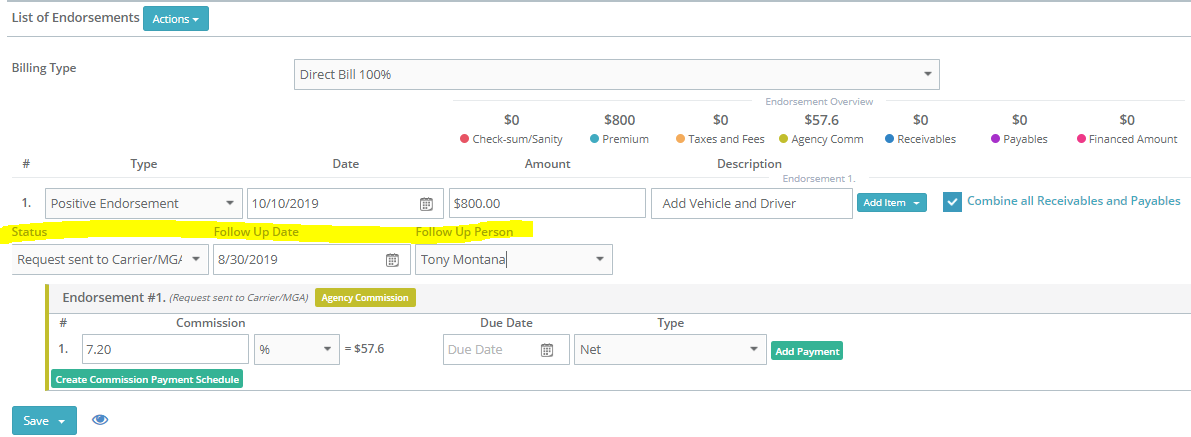

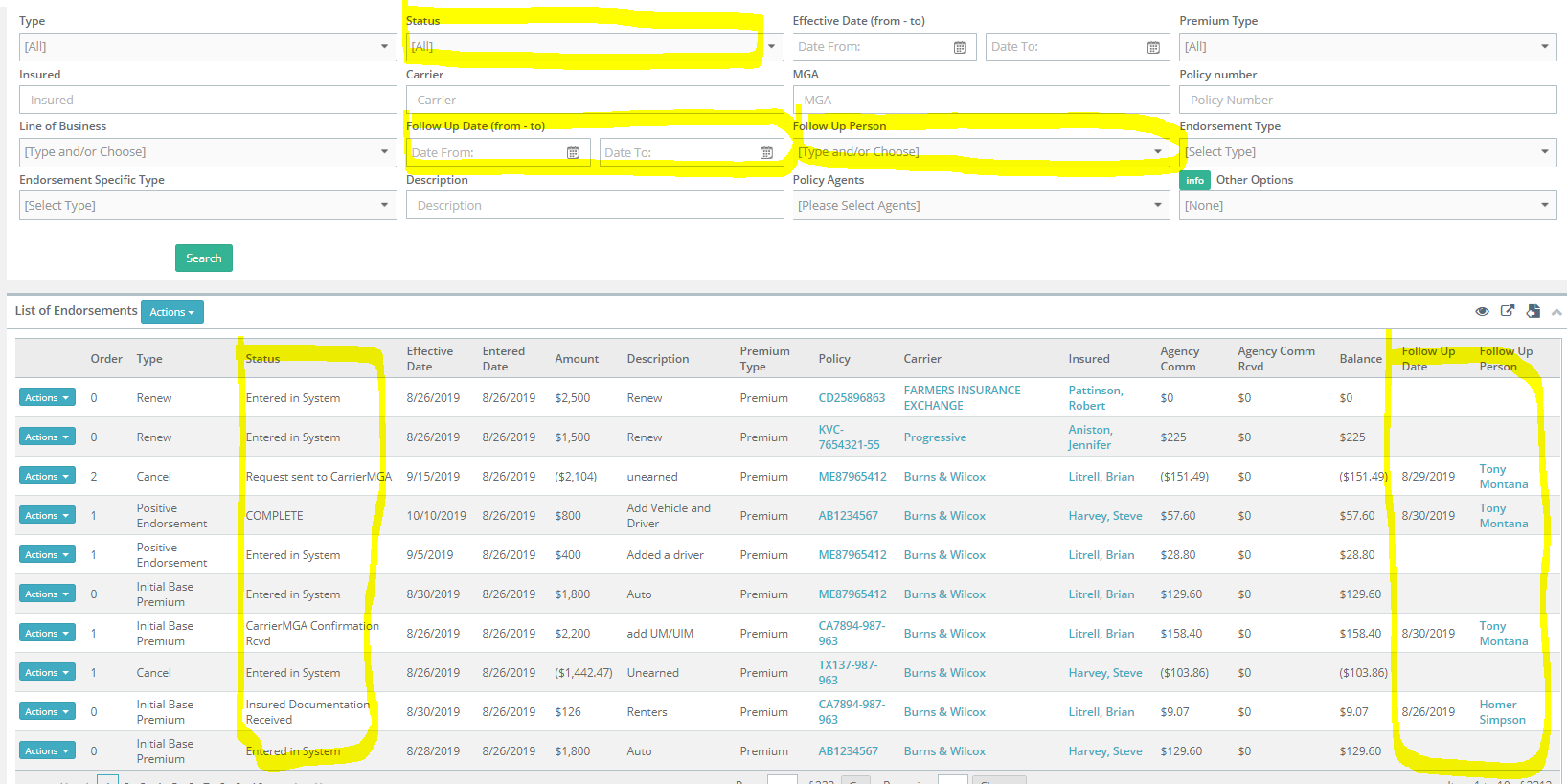

Endorsement Status

"Endorsement Status" is a powerful tool designed to help keep track of endorsements and ensure that nothing "falls through the cracks."

On your navigation menu, go to "Miscellaneous" --> "Endorsements" --> "Endorsements/Fees/Taxes"

As you enter "Endorsements," there is an option to choose a stage or a status. You can also select a follow-up date and a follow-up person.

Then, you can use the "Endorsements" table and its filters to keep track of the status of various endorsements.

The Momentum AMS staff hopes that this brief overview of workflow management tools has provided enough information to encourage you to explore these options and decide which ones match your work responsibilities and preferences.

Please keep in mind that with several options to customize and combine elements of these tools, you have the potential to create powerful workflow management processes.

Training Checklist