Best Practices for Forecasting Cash Flow: Accrual and Cash Accounting Methods

Forecast Agency Commission - forecasting your cash flow

We get this inquiry often from agency owners with respect to policies that pay commission as the premium is paid. In terms of forecasting your cash flow complications arise from the fact that insureds can pay monthly or for 3 months. The best forecast is the average of the last 3 months (adjust for new sales if that is significant).

Within the Momentum AMS, we have a module called "Commission Reconciliation". It is designed to make sure that the carriers send you the commission that they owe you per contract. So, if you set up commission rules for each carrier then the system will calculate "Expected" commission and as the payments come in, we will keep track of total commission received and outstanding balance. At the end of the term, if the balance is not "0" then there is a discrepancy. In theory this works great, and we recommend that agencies use this, especially for Agency billed policies or working with MGAs and E&S lines. This would also work great with DB policies and ones for which the Commission are received either in carrier downloads or imported from a CSV statement.

The problems start to arise when there are discrepancies. There are two major sources of discrepancies.

- the commission rule is wrong, and

- the basis for the commission calculation (premium fees and taxes) is wrong.

We have seen many agencies that don't have the full set of commission rules for a carrier, such as

- Renewal vs New business

- wrong LOB

- packaged policy discounts, etc. etc.

- Or the policy premium was not properly broken between fees and taxes. This could be due to manual entries or can even happen in carrier downloads in certain products and states.

Regardless of the source of discrepancy, once an expected commission is generated that is different than what the carrier actually sent, then it can get messy. The system will have trouble trying to figure out where to apply the commission and what to do with the remaining balances created by the difference in calculations (expected vs received). This can get particularly ugly for policies with multiple endorsements. So, for that reason, we discourage agencies from setting up agency commission rules for carriers that provide Direct Bill commission statements, either via carrier downloads or as excel for import.

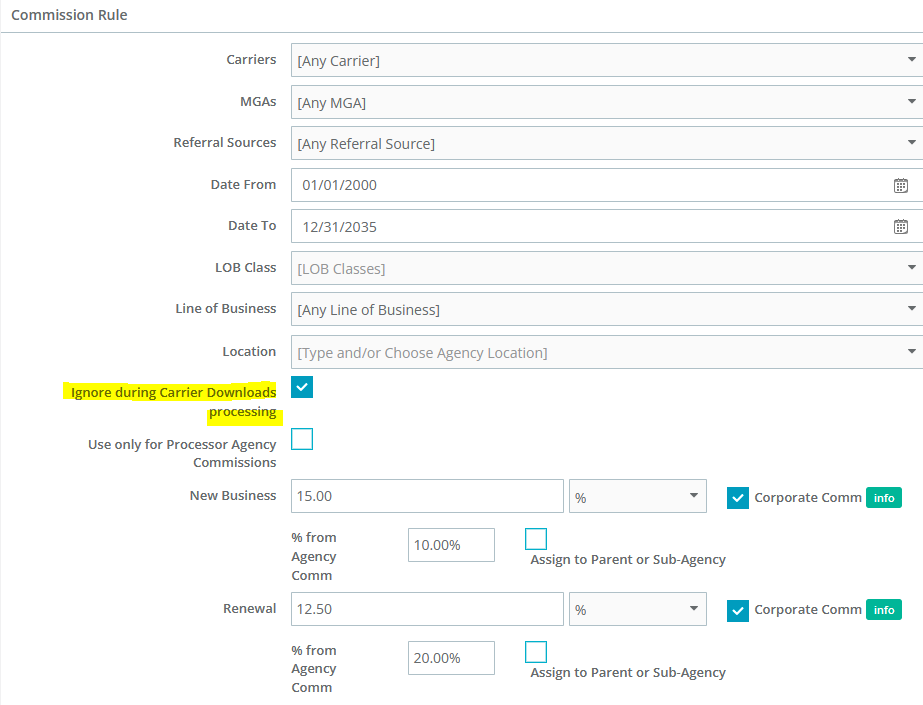

However, we have devised a solution. We have a report that will allow the agency to run reports of Expected commissions, even if such have not been entered in the system. What the report will do is calculate such commission on the fly from a commission rule and entered premium. So, you do need to set up commission rules but also use the setting: "Ignore during Carrier Download Processing"

For your reference:

- Accrual accounting recognizes income and expenses when they are incurred, regardless of when cash transactions occur.

- Cash accounting recognizes income and expenses only when cash is actually received or paid.