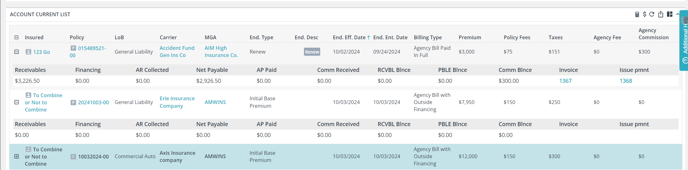

In an Agency Bill W/ Outside Financing arrangement, the agency collects the downpayment from the insured. The remaining premium is financed by a premium finance company.

We will discuss creating an Invoice for Accounts Receivable (AR) and an Issue Payment for the Accounts Payable (AP)

**Please note: Combining Receivables and Payables

- If the box is unchecked, an AR and an AP will be generated for each listed premium/non-premium, and an itemized invoice will be generated.

- If the box is checked, it will result in one total AR, simplifying the invoice. This is especially useful for procuring and processing premium financing agreements using our outside financing integration.

Agency Bill w/ outside financing

Video: https://www.loom.com/share/87bea9dc44064b44990aea12ed914cba

Step-by-Step Instructions:

1. Access Policy Details

- In Billing Type: select Agency bill with outside financing; this will open the proper payable and receivables.

- Navigate to the insured's Policy > select Actions > Details

- Select Billing (top menu)

- Select the billing type Agency Bill with Outside Financing

- Select Endorsement/Fees/Taxes

- Select the Action > Edit Endorsement/Fee

2. Add Premium and Non-Premium

- Start by entering the premium in the initial line

- Add non-premium (fees & taxes) by selecting Add Item (right)

- Select fee or tax type from the pull-down menu, and enter the amount

- Continue until complete using the top "Add Item" for each

- Upon completion, select the Generate Transaction to the right of the premium line item

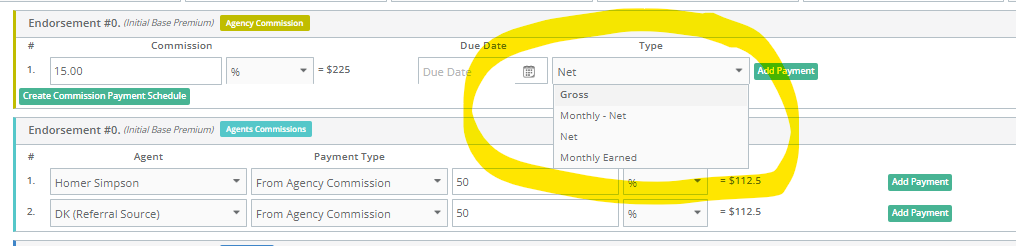

- This will create AR, AP and open up commission tracking

- the default is to generate 25% down and 75% financing; please change these numbers to match the finance agreement

- please note: if you retaining commission, the commission type will be NET. If you are receiving commission from a statement, the commission type is GROSS.

Within the system Gross Commission

3. Creating an Invoice (AR)

- Select documents (top menu)

- Select invoice and Add New

- Select the AR, check for accuracy

- Check the Remittance Section if desired, and

- Finally, select Add in the bottom left

4. Issuing Payments (AP)

- Select documents (top menu)

- Select Issue Payment and Add New

- Select AP and retained commissions, check for accuracy

- Select Add in the bottom left

* There is no need to track the interest as this is not part of the agency income; the finance company will obviously be tracking that.

5. The Final Step is to Record Payments

- Record any payments received from the insured to the invoice. Please note that we are integrating with several merchant services.

- Record payments to the Carrier or MGA to the Issue Payment. It's this action that reconciles Retained Agency Commissions

Account Current Report: A Powerful Tool for Tracking Insured Payments and Managing Disbursements

This report is found within Interactive reports (left main menu).