This article provides a comprehensive guide for billing insureds on monthly or quarterly installment payments.

We will discuss creating an Invoice for Accounts Receivable (AR) and an Issue Payment for the Accounts Payable (AP)

**Please note: Combining Receivables and Payables

- If the box is unchecked, an AR and an AP will be generated for each listed premium/non-premium, and an itemized invoice will be generated.

- If the box is checked, it will result in one total AR, simplifying the invoice.

1. Access Policy Details and Creating Multiple Invoices for AR

Video 1 of 3:

Step-by-step:

- Navigate to the insured's Policy > select Actions > Details

- Select Billing (top menu)

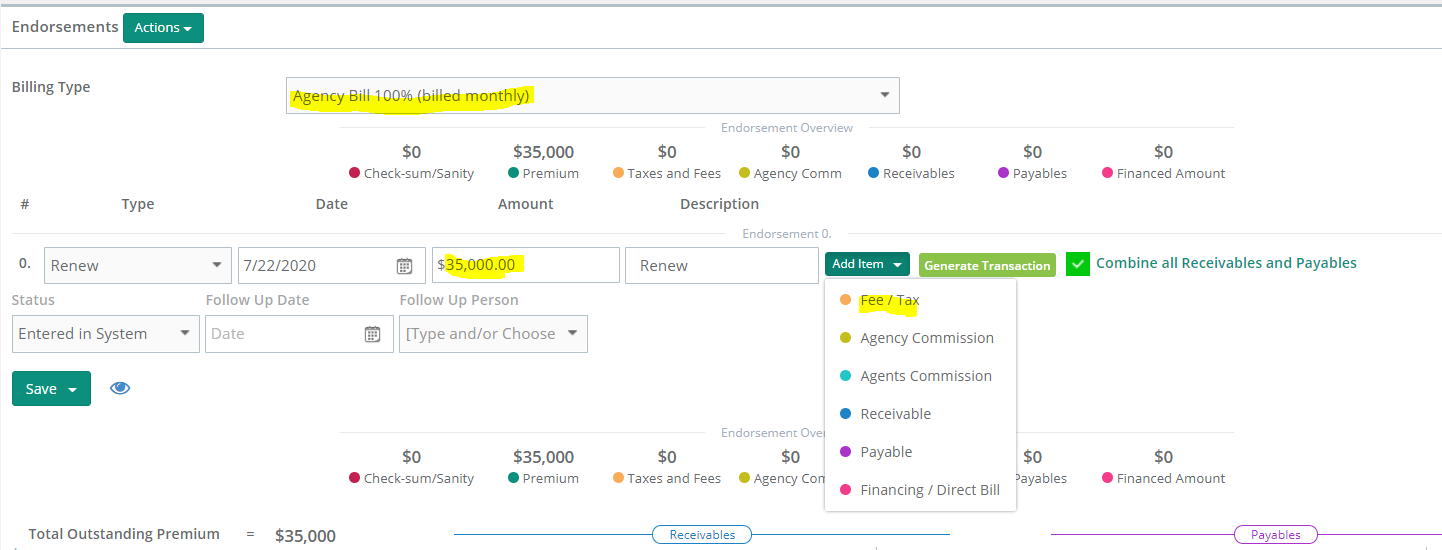

- Select the billing type Agency Bill 100%

- Select Endorsement/Fees/Taxes> select the Action > Edit Endorsement/Fee

- Enter premium (top line item) and each non-premium from the top line item > Add Item

- Then select the tab Generate Transaction (green tab to the right of the premium line item)

2. Setting Payment Terms

Video 2 of 3:

please note: If you're retaining commission, the commission type will be NET. If you are receiving commission from a statement, the commission type is GROSS.

Step-by-step:

- Selecting Down Payment: Select either a downpayment in percentage format, i.e. 25%, or in a $ dollar amount

- Choosing Remaining Payment Frequency: Select the remaining monthly or quarterly payments, i.e. 3 remaining payments or 9 remaining payments.

- Add Processing Fees: if applicable.

- If there are multiple payables to match the AR structure, check the box Add Payables

- Commission Retention Decision: If you are retaining agency commissions as earned, complete the Create Commission Payment Schedule

- Select Save and Create Multiple Invoices

3. Creating Issue Payment for the AP (which will reconcile retained agency commissions)

Video 3 of 3:

Step-by-step:

- Go to Document (top menu)

- Selecting Issue Payment > Add New

- Select the initial AP and the corresponding Commission Payment and Save

- Repeat for the remaining Account Payables and their corresponding retained commissions

4. The Final Step is to Record Payments

- Record any payments received from the insured to the invoice. Please note that we are integrating with several merchant services.

- Record payments to the Carrier or MGA to the Issue Payment. It's this action that reconciles Retained Agency Commissions.

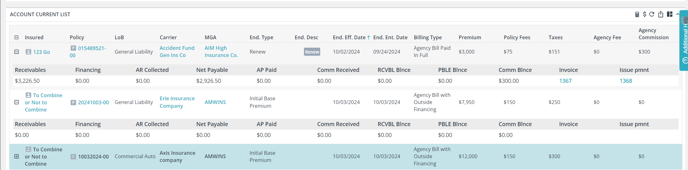

Account Current Report: A Powerful Tool for Tracking Insured Payments and Managing Disbursements

This report is found within Interactive reports (left main menu).